The NSE has 19Mn active clients of all stockbrokers combined as on June 30, 2021, an increase from 12Mn on June 30, 2020, a jump of 58% in one year. Zerodha is the largest, accounting for 19% of clients (up from 15% last year), followed by ICICI Securities and Upstox. (Zerodha has ~2Mn Active clients, ~1Mn Inactive clients)

The number of investor accounts with Central Depository Services (India) Limited (CDSL) has more than doubled from 21.2Mn in March 2020 to 46.4Mn in September 2021. In fact, more than half of the additional 25.2Mn accounts — 13Mn — have come in the last six months between April and September 2021. Even NSDL added nearly 27 lakh accounts between April and September 2021.

Okay, but how many of them were retail investors?

In the last year, the number of retail investors has jumped more than 41 percent, data available with BSE showed. More than 70Mn investors were registered with BSE as of July 8.

Retail investor participation continued to grow exponentially in FY21 as well, with almost 4.5 million retail investor accounts being added in just the first two months of the fiscal year. The total number of retail investors increased by an astonishing 14.2 million in FY21, with 12.25 million new accounts being opened on CDSL 1.9 million in NSDL.

The result is that the Indian stock market is now dominated by retail investors. The NSE alone saw retail investors share grow from 33% in 2016 to 45% in 2021

Why will this number grow?

The industry has the potential to cross INR 100 trillion in AUM in the twenties. Reaching the INR 100 trillion vision during the mid-twenties can help the industry become the 11-13th largest asset management industry in the world from its current standing of 17th largest asset management industry. BCG estimates indicate that achieving this growth will require a 5x increase in the investor base from 20Mn in 2020 to 100Mn investors soon.

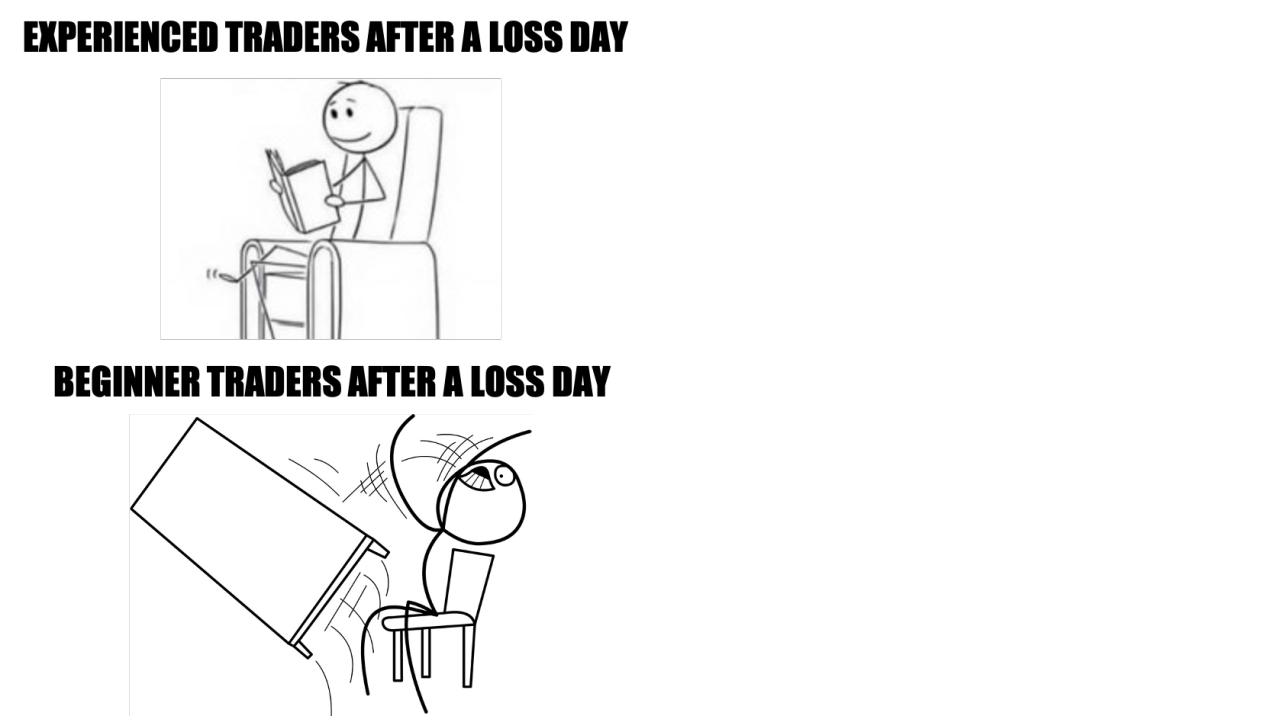

The problem is that the new investors coming into the market do not fully understand the market. A large number of them are in their 20s and 30s taking massive positions in F&O which is a much riskier asset class. A study by ISB showed that the majority of them tend to exit winning trades quickly and hold on to losing trades longer (A textbook mistake done by rookie traders who half gamble due to lack of understanding of the markets)

This is a gap that the market has not been able to fill so far. New traders are not as savvy as the older ones. While there may be enough YouTube videos or upskilling players helping them pick up the tricks of the trade through theory and a few live trade sessions here and there, the vast majority of them do not follow the basic hygiene of being a trader, i.e Building a solid trade setup.

Now the question is – Are the existing stock brokers available in the market well equipped to provide this service to new traders?

The answer would be No. New traders need risk management systems, a chart to track their daily earnings or losses, discipline in setting targets, stopping losses, and risk-to-reward ratios, which today is typically done outside of the brokerage platform and on excel sheets.

India, being one of the fastest growing markets for retail investors in the world with a large market still untapped, needs platforms that help regulate and bridge the learning curve for new investors/traders.

After all, investing in financial freedom is the winning bet of them all!

(If you are a company building in this space, do write to us at sarthak@kae-capital.com)