SUMMARY

With only $9.9 Bn raised in 440+ deals up until June 2022, the average ticket size has been around $22 Mn in H1 2022

Reasons contributing to the same include the complexity of monetisation within the segment, lower ROI and decreased post-pandemic usage, among others

As a consensus, investors have become cautious and are now looking at the sustainability of business models

The Indian consumer internet market, poised to be a $1.6 Tn opportunity by 2025, has seen investors flocking in over the years to grab a share in the startups operating in the fast-growing segment. Yet, between Q3 2021 and Q2 2022, a visible slowdown has been identified within the sector, with only $9.9 Bn raised in 440+ deals between January and June 2022.

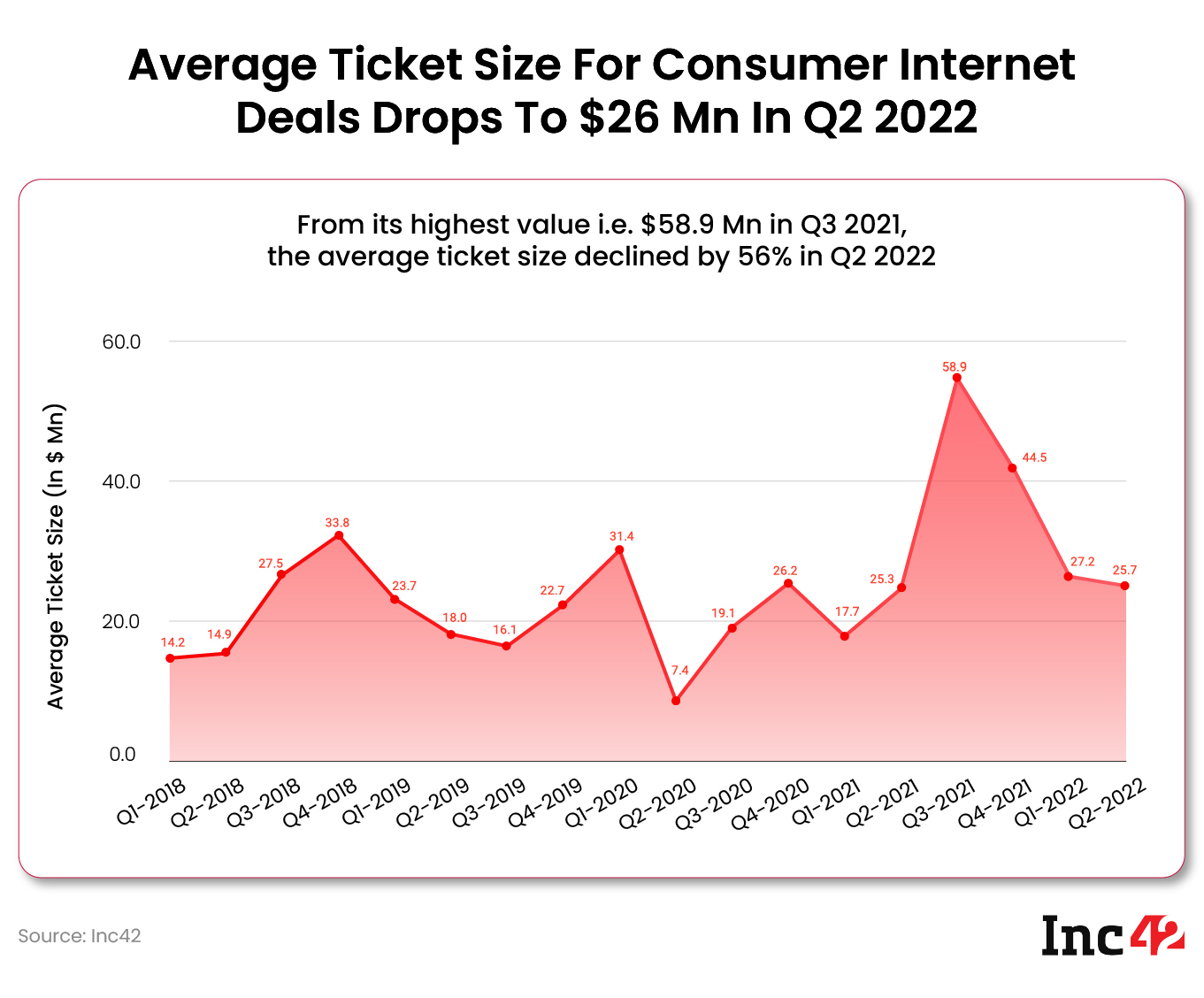

Notably, the overall funding is not the only parameter to have taken a hit. According to Inc42’s ‘State Of Consumer Internet In India, Q3 2022’ report, the average funding ticket size has continued to fall over the last four consecutive quarters.

At its peak in Q3 2021, the average funding raised by a consumer internet startup stood at $59 Mn. The fall was steeper than expected in the following quarters, particularly in Q2 2022. Indian consumer internet startups raised an average of $25.7 Mn in funding in the June 2022 quarter, a 56% decline.

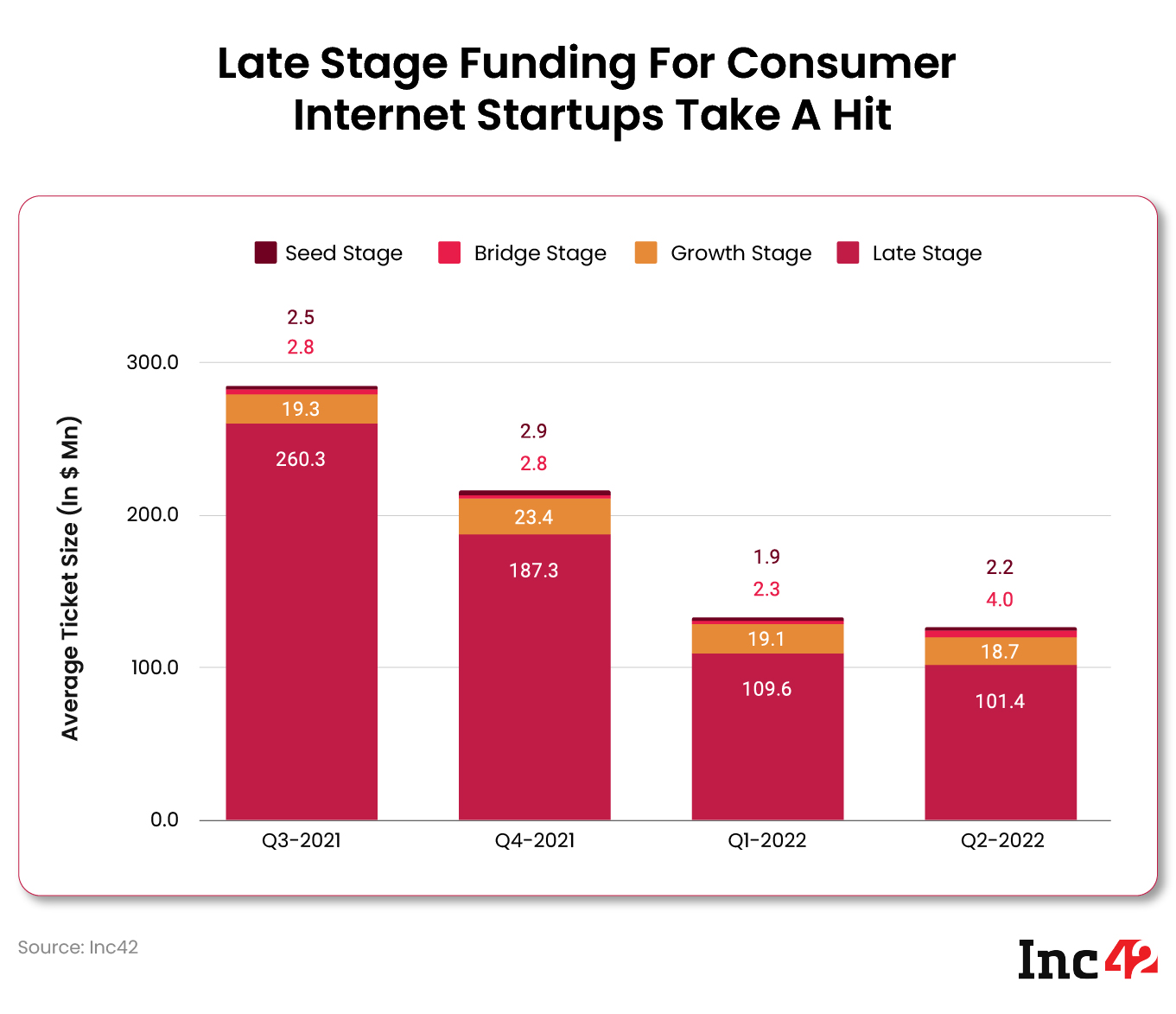

Besides, the average ticket size for late stage funding has also taken a significant hit, falling by more than 60% between Q3 2021 and Q2 2022. According to Krishna Vinjamuri, partner at Kae Capital, the economic slowdown and rationalisation of valuations in the public market had a direct impact on investment in growth stage firms.

“Late stage investors have become cautious and are taking a closer look at the sustainability of business models,” he said.

Echoing similar sentiment, Anjna Bhati, director of data analytics and AI at BluePi, said that the mid to large startups were stalling their business plans and taking time to close their future funding rounds.

Besides, the average ticket size for seed and growth stage startups also took a hit over the last four quarters, with growth stage consumer internet startups having the lowest average ticket size of $18.7 Mn in Q2 2022.

The average ticket size rose only in bridge stage funding, rising to $4 Mn in Q2 from below $3 Mn in the preceding quarter.

Why Does Average Ticket Size Matter?

The increase in the amount of an average cheque pumped within startups resounds the maturity of the ecosystem, but it does not necessarily have to mean that the funding within the ecosystem has fallen. It could also mean that the number of deals has risen.

For instance, in the scenario of the consumer internet startups, late stage startups raised over $3 Bn in funding in 33 deals in Q2 2022, as opposed to over $5 Bn in around 55 deals in Q1 2022. While the averages of both quarters are nearly equal, the funding amount and number of deals are not – implying that a higher funding amount may not necessarily mean a higher average ticket size.

Primus Partners’ Kanishk Maheshwari believes that the current rate of rising inflationary pressures has automatically led to a drying up of funds, but this helps the businesses to bring back focus on the core aspects of their business models.

“This will enable these organisations to be able to course correct and drive growth through holistic measures supporting their internal, external stakeholders, and even the society as a whole. To drive long-term growth, it is important to reinvent, and such cycles take place every 5-7 years to help businesses resurface their focus to serve their various stakeholders.”

On the flip side, a lower average ticket size means a lower entry barrier into the ecosystem. It showcases that the ecosystem needs the money or investors are evaluating the quality of the startup they are likely to put their money into.

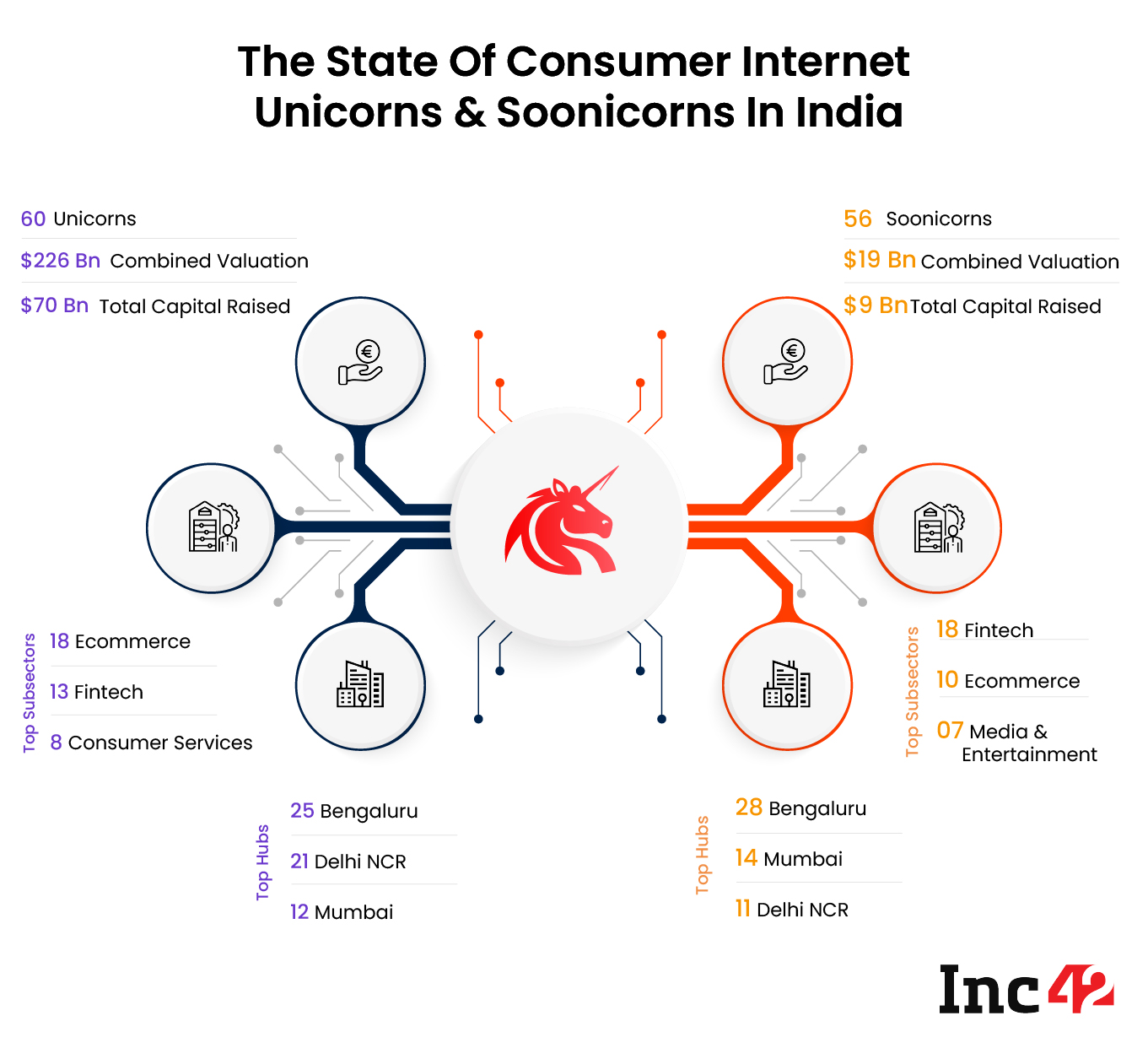

India is home to more than 2.6K unique, funded consumer internet startups, and the inflow of $84 Bn in funding between 2014 and H1 2022 underlines that investors have been betting big on this segment. The ecosystem also houses 60 unicorns out of the total 106 unicorns and eight of the 12 listed startups.

Major sectors like fintech, ecommerce and consumer services have witnessed enhanced investor interest during this period. As the country prepares to roll out 5G services, with 500 Mn subscribers expected to join the 5G bandwagon by 2027, India’s internet ecosystem is poised to grow significantly. It will witness the emergence of many more startups.

Thus, it has become imperative to understand the key reasons behind the fall in average ticket size funding, and what the future holds.

Reasons Behind The Decline & What Startups Can Do

While India added about three unicorns every month in 2021, the VC funding for the consumer internet segment in 2022 significantly slowed down.

Harish Kumar, MD of Protiviti Member Firm for India, said the possibility of an economic slowdown, rising interest rates due to a jump in inflation, increased cost of capital, and supply chain disruptions, among others, can lead to the decline in funding.

However, he said that in such periods, investors look for opportunities in startups facing sharp corrections in their valuation or businesses with innovative ideas or technology in specific low-risk sectors like ecommerce.

Several analysts, experts and investors Inc42 spoke to, following the launch of the consumer internet report for Q2 2022, shared a similar sentiment.

Tough To Monetise Consumer Internet Ecosystem

India’s consumer internet economy is the second-largest in the world, with the number of users expected to rise to 1.3 Bn by 2030 from over 800 Mn users currently. While the advent of 4G services fuelled the rise of several consumer-focussed startups in the country, the Covid-19 pandemic gave a further boost to the consumer internet ecosystem.

However, according to Vaibhav Domkundwar of Better Capital, one of the reasons for the slowdown in consumer internet spending is that the current user base is not monetisable.

“Even when one can build scale in consumer internet, it has been tough to build a positive unit economics business model. Billions have been poured into the sector, but billions have not been made – far from it. Consumer internet startups that build layers close to a transaction, or lead to a transaction, are likely better segments to find a scalable & profitable business model,” he said.

VC firm NorthSide’s founder Vidur Vyas also said that over the last 7-8 years, many startups chased scale at the expense of the right business model, which resulted in “dilution”.

He advised startups that should work on getting their business model right along with scale, number of customers, revenue per customer and profitability.

Funding Winter And The General Distress

India Accelerator cofounder Ashish Bhatia attributed the funding slowdown to the funding winter caused due to the rise in interest rates by the US Federal Reserve.“Investors began to tighten the funding tap for Indian startups and there are so many external factors driving this (funding) freeze. It is reasonable to expect it to last another year.”

Concerned about the funding inflow within the funds, Bhatia added that investors who have raised funds cannot continue to wait because startup investments have the longest gestation period before exiting and the deployment clock is also ticking for them.

Meanwhile, according to Vikram Gupta, founder and managing partner, IvyCap Ventures, the funding winter has led the startups to shift their focus to profitability and cost-cutting.

As the startup funding plummeted amid a ‘funding winter’, late stage startups have taken the lead in the unfortunate layoffs in the ecosystem. So far, 11K+ employees have been laid off by 34 startups, which includes unicorns such as Vedantu, Cars24, Ola, Meesho, MPL and Unacademy.

The Post-Pandemic Woes

While the funding crunch is one of the reasons for the decline in average ticket size, another reason is that some of the sectors saw extraordinary growth during the pandemic which is now slowing down.

Protiviti’s Kumar said that specific startups within edtech and gaming witnessed unprecedented demand during the pandemic, attracting a large number of investors. However, the growth has plateaued now, resulting in a fall in valuations and funding.

“Many startups are taking cost-controlling measures like cutting down on cash burn and downsizing manpower to sustain during this period. This trend is likely to continue for some more time until economic conditions and market sentiments improve,” he said.

IvyCap Venture’s Gupta also said that amidst the pandemic, virtual product launches and influencer marketing became the key drivers of business models and led to an unprecedented rise of consumer internet companies in the last two years. However, most of the new-tech startups didn’t even consider going for IPO, suggesting investor apprehension in funding these companies, he said.

However, Kae Capital’s Vinjamuri pointed out that the internet consumption pattern in India continues to show secular growth and the trend is unlikely to change. “Funds have more time to engage the founders and back strong business models with greater conviction. Startups at large should focus on building a strong customer value proposition while ensuring good unit economics,” he advised founders.

The Profitability Approach

Safir Anand, senior partner at Anand and Anand, attributed the decline in average ticket size of funding to investors not paying enough attention to the business models of the startups and valuing them too high.

Pointing to the financial results of large investors such as SoftBank and Tiger Global, Anand said that private equity players are not playing a fair game with the “excessive valuation” of the startups, and as a result are losing billions of dollars.

“Since many of these businesses are intangible-centric, even the valuations there overlooked every aspect by benchmarking every new venture with only success stories and not failures or industry averages,” he added.

Several experts have also argued that the drop in average ticket size for funding as against a major decline in the number of deals suggests that investors are in a wait-and-watch mode and demanding long-term sustainability from startups.

“Investors want to focus on profitability and revenues rather than growth. Brands, on the other hand, are reluctant to give away partial control of the business to investors. However, the experienced funding community looks at this as only temporary fluctuations in the market and many investors will remain in acceleration mode and on alert,” Anjna Bhati of BluePi stated.

Key Trends That Will Shape The Consumer Internet Ecosystem

Contrary to the popular opinion of funding winter, early stage VC firm Huddle’s Sanil Sachar told Inc42 that the ‘winter’ hasn’t impacted early stage funding yet. “I am hopeful (that) with the correct action, there can be a correction which helps early stage (startups) to learn from the reasons behind the decline in funding and come out on top.”

As for the consumer internet ecosystem, he added that there seems to be a change in the definition of ‘winning ventures’ in terms of applications.

“At first it was topline growth which enabled startups to showcase their user base, active user behaviour and downloads. However, the true factor of success is seeing what this user base helps yield in the form of return and revenue,” Sachar said.

Sanket Sinha, executive director and global head of asset management at Lighthouse Canton, said that investors are looking for companies with strong fundamentals, established product market fit, capital efficiency, a greater value proposition for stakeholders, a well-experienced team, profitable unit economics, and minimal cash burn in the growth spree.

Speaking about the expected changes in the ecosystem going ahead, BluePi’s Bhati said that government schemes will play a greater role in helping startups attract investors, freelance talent recruitment will be preferred over full-time jobs, automation and digital-first interactions with customers will rise, and immersive customer experience and conscious consumerism will gain prominence.