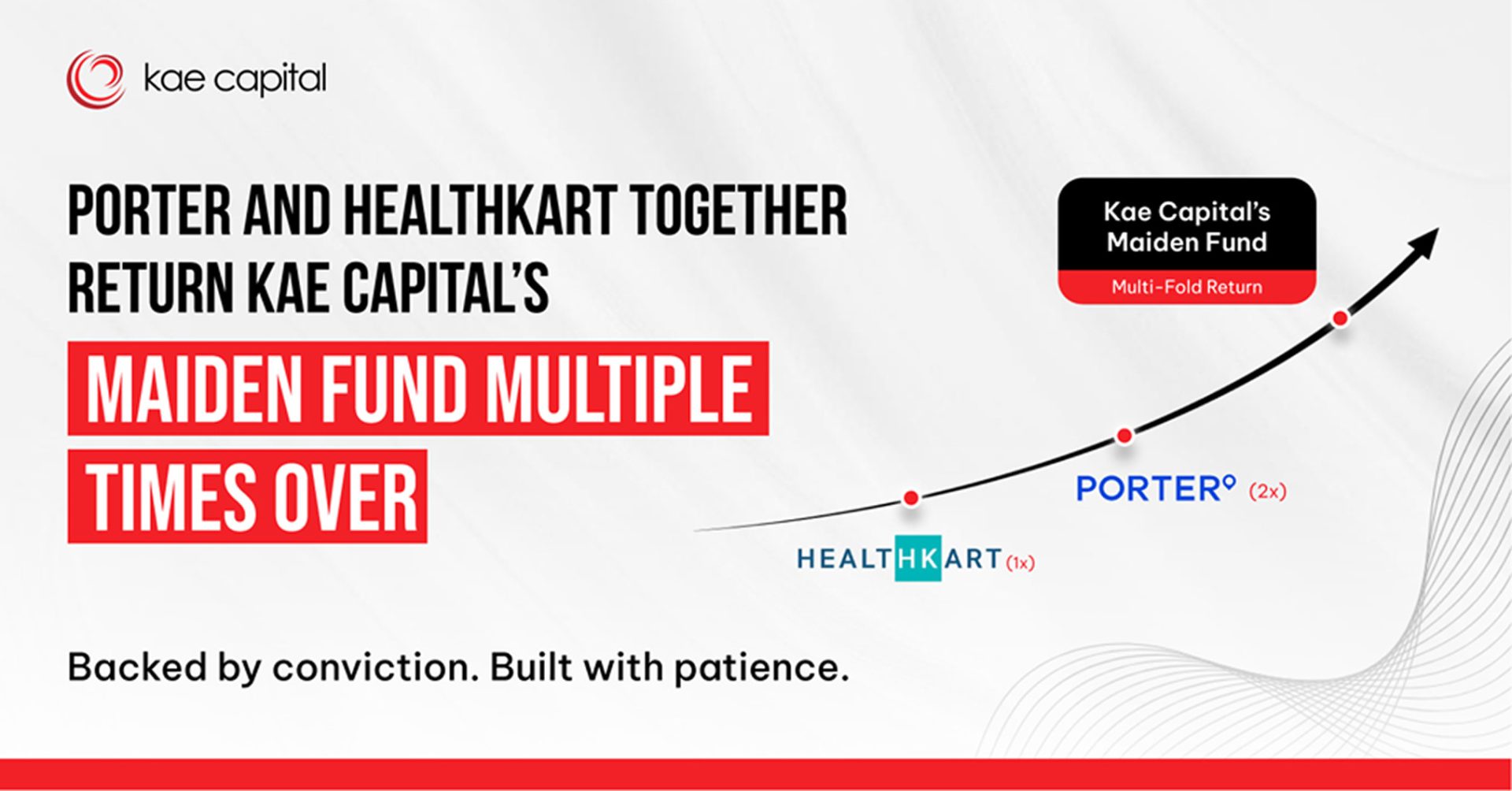

Fund-returners Porter (~2x) and HealthKart (1x) anchor one of the strongest seed track records in the country

When we started Kae Capital in 2012, institutional seed investing in India barely existed. The startup ecosystem was young, and the idea of writing structured pre-seed and seed cheques felt unconventional. But we believed India’s most iconic companies would be built from bold, untested ideas; ideas that simply needed conviction, capital, and care early on.

That conviction has compounded.

Today, we’re proud to share a milestone that underscores that belief: Porter and HealthKart, two of Kae Capital’s earliest investments, have together returned our maiden Fund I multiple times over.

Following a series of recent secondary transactions, Porter has already returned more than 2x the fund, while HealthKart has returned the fund on its own, with meaningful upside still ahead. These are not just standout portfolio outcomes, they represent proof that India’s early-stage venture model can deliver real distributions and enduring impact.

A Landmark Fund Performance

Launched in 2012, Fund I backed 32 companies across India and the US. Many of these grew into category-defining leaders that reshaped their sectors and validated India’s potential to produce global-scale companies from the earliest stages.

Kae Capital’s Fund I India vehicle fully exited with a DPI of 3.6x as of September 2023, while the overseas vehicle is on track to deliver over 5x DPI. Together, they mark one of the strongest maiden fund performances by a homegrown venture capital firm, not only in India but benchmarked against global peers.

The portfolio features enduring leaders such as 1MG, now the country’s largest online pharmacy under the Tata umbrella, and Certa, a fast-scaling global compliance and risk platform. Other notable outcomes include Fynd (formerly Shopsense, acquired by Reliance), Dailyround, Airwoot, and Eventifier, each contributing to the fund’s stellar performance and ecosystem impact.

In total, Fund I catalyzed over $900 million in follow-on capital, created more than 56,000 jobs, and enabled over $2.7 billion in enterprise value across its portfolio.

“When we raised Fund I, seed investing in India was almost unheard of. Our goal was simple, back extraordinary founders at their earliest stages and stand with them across cycles. To now deliver a top decile DPI number on that very first fund is deeply gratifying. It is a milestone shared with our founders, LPs, and the ecosystem that believed in us before it was fashionable to do so,” said Sasha Mirchandani, Founding Partner, Kae Capital.

Building a Model for Early-Stage Venture

Fund I’s legacy is not just measured in multiples. It established a new way of approaching early-stage venture; one rooted in conviction, discipline, and deep partnership with founders.

This foundation shaped every fund that followed. With Fund II, Kae backed companies that have gone on to define their categories: Zetwerk, now one of India’s most successful manufacturing platforms and a soon-to-be public market entity; Nazara, India’s first listed gaming unicorn; and Snapmint, a pioneering BNPL and embedded finance platform enabling consumer credit inclusion at scale.

Fund III, launched in 2022, is already showing strong momentum with fast-scaling brands like Traya, Foxtale, and RecommerceX, reflecting Kae’s continued commitment to backing durable, high-scale businesses driven by innovation and execution.

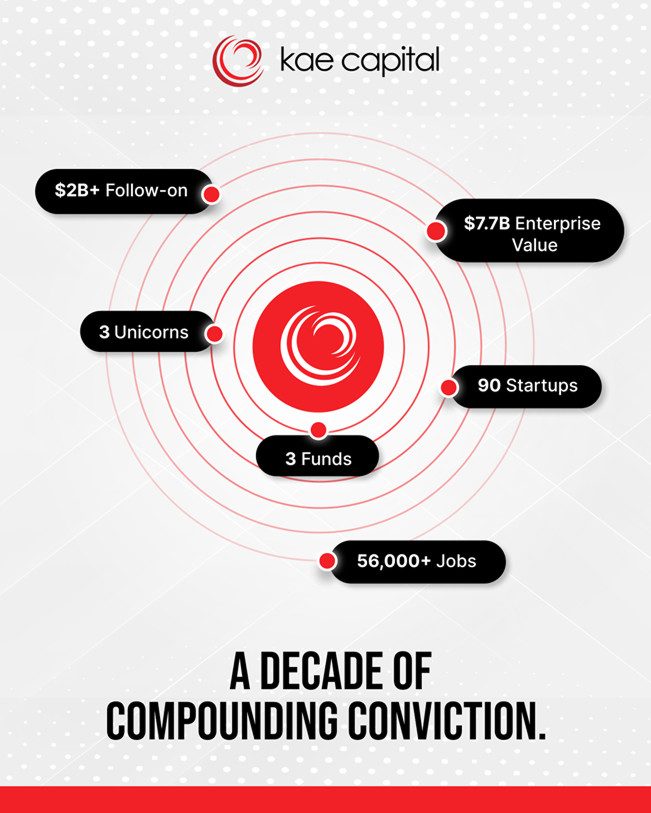

Across its three funds, Kae Capital has backed three unicorns, generated $7.7 billion in enterprise value, attracted over $2 billion in follow-on capital, seeded five companies with $100 million-plus in revenue, and contributed to tens of thousands of new jobs in the Indian economy.

“Fund I’s DPI is not just a number; it’s a symbol of what’s possible when early conviction meets enduring partnership,” said Gaurav Chaturvedi, Partner, Kae Capital. “We are proud to have played a role in shaping some of India’s most exciting companies and even prouder of the trust placed in us by our founders and LPs. This is only the beginning.”

What Fund I Taught Us

Every fund leaves behind a set of lessons. Fund I gave us principles that continue to define how we think, invest, and partner with founders today.

- Patience compounds

Enduring companies take time. The ability to stay invested, mentally and financially, through the quiet years often determines the eventual outcome. - Resilience over momentum

Markets shift. Business models evolve. The founders who last are those who adapt fast but stay anchored to first principles. - Founder first, always

When things break, markets and models matter less than trust. Honest, early conversations often save more companies than strategies ever do. - Teams are the true moat

Strong, complementary teams outperform solo brilliance. Founders who can disagree well tend to outlast the rest.

These lessons became the DNA of Kae’s platform. They informed the construction of Fund II and Fund III, which are today backing some of India’s most transformative companies.

All Weather Partner

Kae’s performance is inseparable from its philosophy. The firm has consistently partnered with founders through pivots, crises, and inflection points.

Amrit Acharya, Co-Founder of Zetwerk, recalls: “From our first round to navigating COVID and scaling into a large company, Kae has been thoughtful, proactive, and solution-driven. They’ve consistently added value.”

Pranav Goel, Co-Founder of Porter, adds: “Having Kae Capital since the very start has been a sheer delight. Their unwavering support, especially during tough times, helped us cut through the clutter and focus on building.”

Such endorsements reflect a core truth: Kae’s success is built on trust. The firm remains one of the few VCs in India to track founder NPS, which stands at 88%.

Looking Ahead

As India enters its next wave of innovation, Kae is deepening its focus on sectors that will define the country’s next decade; AI, intelligent automation, manufacturing resilience, and deeptech. These are the technologies that will drive self-reliance, productivity, and global competitiveness.

Kae’s mission remains unchanged: to back visionary founders from the first cheque through scale, helping them build enduring, globally competitive companies.

Fund I is a strong reminder for us that conviction, patience, and partnership are the most valuable currencies in venture capital, and that, sometimes, belief compounds faster than capital.