“The future of money is digital currency.” – Bill Gates

Introduction: The Digital Currency Paradox

Cryptocurrency promised to revolutionize money; borderless, instant, and decentralized. Yet Bitcoin’s 80% volatility swings and Ethereum’s price fluctuations made them impractical for everyday transactions. Would you buy coffee with an asset that could gain or lose 10% of its value before you finish drinking it?

Enter stablecoins: the missing link between crypto’s technological promise and traditional finance’s reliability. These digital assets offer the speed and programmability of blockchain technology while maintaining the predictability that real-world commerce demands.

What Are Stablecoins?

Stablecoins are cryptocurrencies engineered to maintain a stable value by pegging themselves to external references, typically fiat currencies like the US dollar. Think of them as digital dollars that move at the speed of the internet, combining the best attributes of both worlds: cryptocurrency’s technological infrastructure with traditional currency’s price stability.

The value proposition is compelling: near-instant settlement, 24/7 availability, minimal transaction costs, and global accessibility; all while avoiding the volatility that has plagued cryptocurrencies since Bitcoin’s inception.

The Four Architectures of Stability

Not all stablecoins are created equal. Their stability mechanisms fall into four distinct categories, each with unique tradeoffs:

1. Fiat-Backed Stablecoins

The most straightforward approach: for every digital token issued, one US dollar (or other fiat currency) sits in a bank account or treasury. USDC and USDT exemplify this model, offering 1:1 redemption guarantees backed by regular attestations from auditors.

Strength: Simplicity and trust. Users understand that real dollars back their digital tokens.

Weakness: Centralization and regulatory dependence. A bank account can be frozen; regulators can intervene.

Fiat-backed stablecoins dominate the market because they’re intuitive. When Circle says one USDC equals one dollar, that promise is backed by tangible reserves; US Treasury bills, cash, and short-term securities. This transparency has made them the preferred choice for institutions entering crypto.

2. Crypto-Backed Stablecoins

Rather than holding fiat, these stablecoins use other cryptocurrencies as collateral. DAI, created by MakerDAO, pioneered this approach by allowing users to lock up volatile assets like Ethereum to mint stablecoins.

The catch? Over-collateralization. To mint $100 worth of DAI, you might need to deposit $150 worth of Ethereum. This buffer protects against price crashes, if Ethereum drops 20%, the collateral still covers the debt.

Strength: Decentralization. No bank accounts, no single point of failure, transparent on-chain governance.

Weakness: Capital inefficiency. Your money works harder sitting in a savings account than locked as excess collateral.

3. Algorithmic Stablecoins

The holy grail, or the house of cards, depending on whom you ask. These stablecoins use smart contracts and algorithmic mechanisms to maintain their peg without any collateral, expanding and contracting supply based on demand.

TerraUSD’s spectacular $40 billion collapse in May 2022 demonstrated the risks. When market confidence evaporated, the algorithm couldn’t defend the peg, triggering a death spiral that wiped out billions in value within days.

Strength: Maximum capital efficiency and true decentralization.

Weakness: Reflexivity risk. They work beautifully until they don’t, and when confidence breaks, the collapse can be catastrophic.

The crypto community remains divided on whether algorithmic stablecoins can ever be truly stable. Some see them as fundamentally flawed; others believe the right design simply hasn’t been discovered yet.

4. Commodity-Backed Stablecoins

These peg their value to physical assets – gold, real estate, or other commodities – offering exposure to tangible value rather than fiat currency. Paxos Gold (PAXG) lets you own fractional gold bars stored in London vaults, tradable 24/7 without the hassle of physical custody.

Strength: Intrinsic value independent of any currency or government.

Weakness: All the complications of physical asset custody, verification, and redemption.

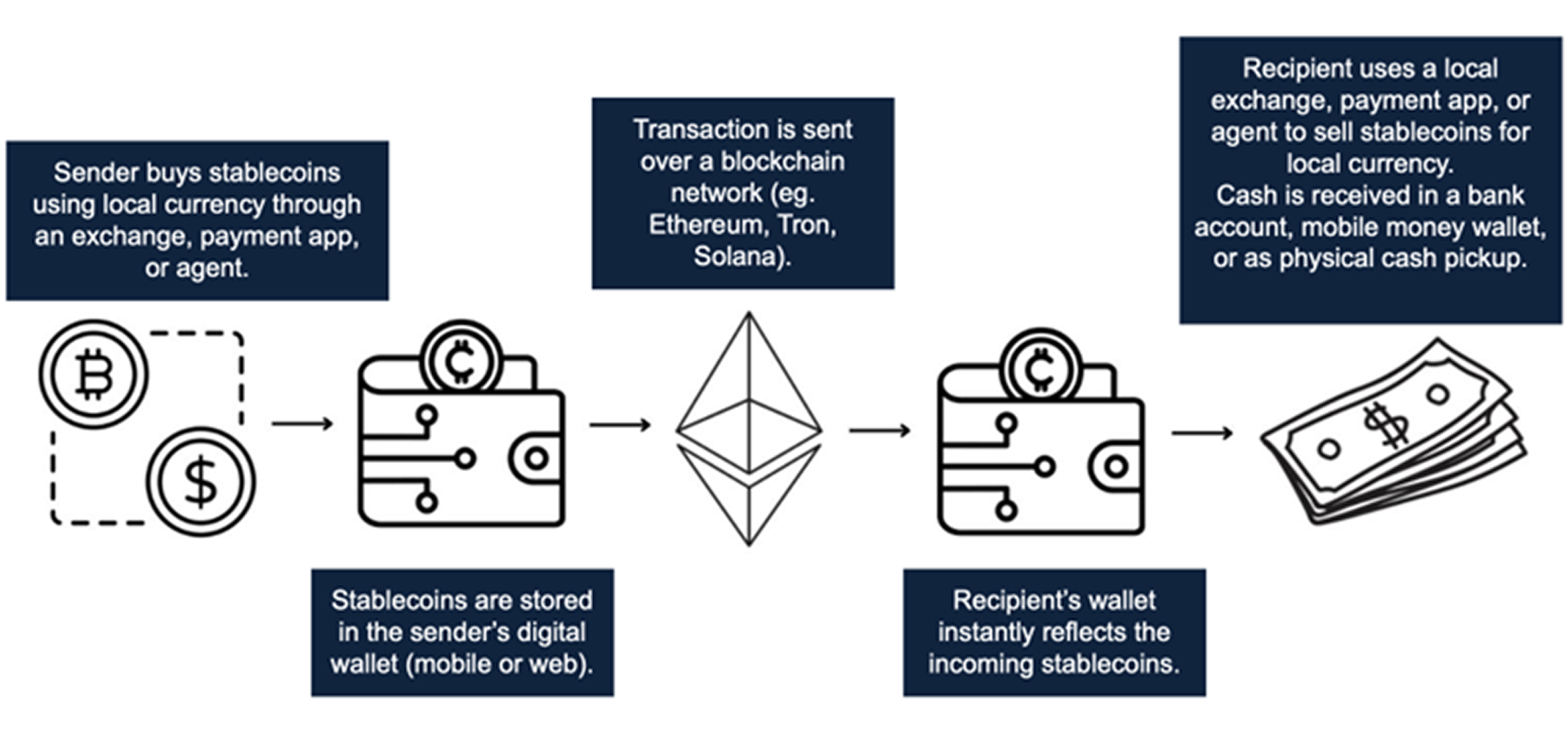

The Mechanics: How Stablecoin Transfers Actually Work

When you send $1,000 via traditional banking rails internationally, here’s what happens:

- Your bank initiates the transfer

- It routes through correspondent banking networks

- Currency conversion occurs (often with opaque spreads)

- The recipient’s bank receives and processes the payment

- Total time: 3-5 business days. Cost: 3-8% in fees

Compare this to a stablecoin transfer:

- You convert fiat to USDC at an exchange or on-ramp

- Send USDC directly to the recipient’s wallet

- The recipient converts USDC back to local currency or keeps it as digital dollars

- Total time: 10 seconds to 5 minutes. Cost: $0.01-$5

The difference isn’t incremental, it’s transformational. The transaction settles on the blockchain layer, bypassing legacy financial infrastructure entirely. Smart contracts handle escrow and conditions automatically. There’s no “business hours” limitation; transfers happen at 3 AM on Sunday just as easily as Tuesday afternoon.

Real-World Pain Points Solved

Cross-Border Remittances

The World Bank estimates that global remittances exceed $700 billion annually, with developing countries receiving over $600 billion. Yet families pay exorbitant fees to send money home.

A construction worker in Dubai sending $500 to Mumbai via traditional channels might lose $40 to fees and forex spreads, 8% gone before the money reaches his family. With stablecoins, that same transfer costs under $5 and arrives in minutes rather than days.

The math is stark: if stablecoins captured just half of India’s $125 billion in annual remittances and reduced costs from 6% to 0.5%, Indian families would save approximately $7 billion per year. That’s real wealth preserved rather than extracted by intermediaries.

Treasury Management for Businesses

Global companies struggle with trapped liquidity, money stuck in foreign accounts due to slow, expensive repatriation processes. Stablecoins enable instant global treasury management: move capital between subsidiaries, pay suppliers in different countries, or rebalance currency exposure in real-time.

CFOs can now optimize working capital minute-by-minute rather than waiting days for international wires to clear. This liquidity efficiency alone can improve returns on corporate cash balances by several percentage points.

DeFi and Yield Generation

Stablecoins unlocked decentralized finance’s potential. Before them, earning yield on crypto meant accepting massive volatility risk. Now, protocols offer stable yields on stablecoin deposits, money markets, liquidity pools, and lending protocols all denominated in assets that don’t fluctuate wildly.

While yields have normalized from DeFi’s early days, stablecoin-denominated opportunities still frequently exceed traditional savings rates, all accessible 24/7 without geographical restrictions.

Market Size and Growth Trajectory

The stablecoin market’s growth has been exponential. Total supply crossed $200 billion in 2024, with daily transaction volumes regularly exceeding traditional payment networks for certain corridors. Tether alone processes more daily transaction volume than PayPal.

This isn’t speculative trading volume, it’s real economic activity. Merchants accepting crypto payments prefer stablecoins. Cross-border businesses use them for settlements. Traders use them as on-ramps and safe havens during market volatility.

Circle’s recent public market debut crystallized institutional sentiment. The company’s valuation jumped from $8 billion to $58 billion, reflecting investor conviction that stablecoins aren’t a niche crypto phenomenon but fundamental financial infrastructure for the digital age.

The Giants Leading the Space

Tether (USDT)

The controversial king. Tether dominates with over $140 billion in circulation, providing the primary liquidity bridge across crypto exchanges globally. Nearly every trading pair includes USDT, making it crypto’s de facto dollar.

Critics point to opacity around reserves and historical regulatory issues. Supporters note Tether has maintained its peg through multiple crypto winters and operates as critical infrastructure for the entire ecosystem.

Circle (USDC)

The regulated alternative. Circle built USDC with compliance and transparency as core features: monthly attestations from Grant Thornton, reserves held in US-regulated institutions, and deep integration with traditional finance.

Major institutions have embraced USDC: Visa settles transactions in it, Stripe accepts it for payments, and BlackRock manages a portion of its reserves. Circle represents the path where crypto and TradFi converge rather than compete.

Paxos

The infrastructure provider. Rather than just issuing its own stablecoin, Paxos powers white-label solutions for major brands. PayPal USD runs on Paxos infrastructure, as did Binance USD before regulatory headwinds.

Paxos’s strategy recognizes that distribution matters more than technology. Why build blockchain expertise in-house when you can partner with a regulated stablecoin issuer?

MakerDAO (DAI)

The decentralization maximalist. DAI proves that stablecoins don’t require centralized issuers. Governed by token holders through on-chain voting, MakerDAO represents crypto’s ideological heart, building systems that can’t be censored or controlled by any single entity.

DAI has maintained its peg through extraordinary market stress, demonstrating that decentralized stability mechanisms can work when properly designed.

India: A Case Study in Opportunity and Tension

India presents the world’s most compelling stablecoin case study, a perfect storm of massive potential colliding with regulatory skepticism.

The Opportunity

India receives more remittances than any country on Earth: over $125 billion annually. Much of this flows through expensive channels like Western Union or Remitly, with fees ranging from 3-8%. For families receiving $200-300 monthly, these costs are devastating.

Additionally, India ranks #1 globally in grassroots crypto adoption according to Chainalysis. Despite a 30% tax on crypto gains and 1% TDS on transactions, millions of Indians actively use digital assets. This reveals enormous latent demand that punitive taxation hasn’t suppressed.

The infrastructure exists too. UPI processes billions of transactions monthly, proving India’s readiness for digital payment innovation. Integrating stablecoins with UPI could create a seamless fiat-to-crypto-to-fiat experience.

The Regulatory Hurdle

The Reserve Bank of India remains deeply skeptical. Governor Sanjay Malhotra has repeatedly warned that cryptocurrencies pose risks to financial stability, monetary policy transmission, and capital account management.

The concerns aren’t baseless. If Indians suddenly prefer holding USDC over rupees, it could trigger capital flight and undermine monetary sovereignty. Dollarization via stablecoins could constrain the RBI’s policy tools.

However, this binary framing, ban crypto or accept dollarization, misses the middle path: rupee-pegged stablecoins. A digital rupee stablecoin, properly regulated and integrated with banking infrastructure, could capture stablecoin benefits while maintaining monetary sovereignty.

The Digital Rupee Experiment

India’s Central Bank Digital Currency (CBDC) pilot represents official recognition that money is going digital. The e-Rupee integrates with UPI and enables programmable money, government benefits that can only be spent on food, subsidies that expire if unused, instant targeted stimulus.

Yet adoption has lagged expectations. The e-Rupee offers innovation but lacks the openness and interoperability that make stablecoins powerful. You can’t easily convert e-Rupees to dollars, integrate them with global DeFi protocols, or build permissionless applications on top.

The question becomes: Can a government-controlled CBDC satisfy the same needs as open stablecoins? Or will Indians continue seeking dollar-denominated digital assets regardless of official alternatives?

Indian Startups Bridging the Gap

Despite regulatory uncertainty, Indian entrepreneurs are building:

BriskPe focuses on B2B cross-border payments, helping businesses bypass traditional banking delays. By routing payments through stablecoin rails, they’ve reduced settlement times from days to hours while cutting costs by 60-80%.

Celeriz targets the massive remittance corridor between the Gulf states and India. Their infrastructure lets workers in Dubai or Kuwait send USDC home, where it’s instantly converted to rupees, no Western Union counter required.

Infinity provides treasury management solutions for companies dealing with multiple currencies. Their platform uses stablecoins as the settlement layer, allowing businesses to hold, convert, and transfer value globally without maintaining accounts in dozens of countries.

These startups operate in regulatory gray zones, but they’re proving market demand. If India eventually establishes clear frameworks, they’ll be positioned to scale rapidly.

The Path Forward: Regulation and Maturation

Stablecoins occupy an awkward position: too important to ban, too disruptive to ignore, too novel for existing regulations.

The United States is moving toward comprehensive stablecoin legislation, with bipartisan support for frameworks requiring reserve backing, regular audits, and redemption guarantees. The European Union’s MiCA regulations already provide clarity, requiring issuers to maintain reserves and obtain authorization.

In Asia, Singapore and Hong Kong are attracting stablecoin issuers with progressive regulations. Even China, which banned crypto trading, is exploring wholesale CBDC systems that function similarly to institutional stablecoins.

The pattern is clear: outright bans are giving way to regulated frameworks. The question isn’t whether stablecoins will be regulated, but how and whether regulations foster innovation or stifle it.

Conclusion: The Inevitability of Digital Dollars

Stablecoins aren’t speculative assets or ideological projects, they’re practical financial infrastructure that works better than alternatives for specific use cases. When my transfer arrives in 30 seconds instead of 3 days, when I pay $2 in fees instead of $40, when I can move money at midnight on Sunday, that’s not theoretical; it’s tangible improvement.

For India specifically, the stakes are enormous. As the world’s largest remittance market with cutting-edge digital infrastructure and demonstrated crypto appetite, India could either lead the stablecoin revolution or watch capital and innovation flow to friendlier jurisdictions.

The Reserve Bank’s concerns about monetary sovereignty and financial stability deserve serious consideration. But the solution isn’t prohibition, it’s smart regulation. Rupee-pegged stablecoins, integrated with UPI, subject to reserve requirements and audits, could deliver stablecoin benefits while addressing sovereign concerns.

Bill Gates was right: the future of money is digital. The only question is whether that digital future will be open and programmable like stablecoins, controlled and closed like CBDCs, or some hybrid that captures the best of both.

One thing is certain: money is going digital with or without permission. The winners will be those who build the best rails for its movement.