The SMB (small and medium business) story is not a new one in India. Contributing to over 30% of the Indian GDP, the MSME sector is the bedrock of aspirational India. Incumbents like Tally, IndiaMART, and Zoho solved for various key organisation activities (like accounting/bookkeeping, vendor/buyer discovery and CRM respectively), paving the way for a wave of mobile-first technology tools.

We saw the first wave between 2014-18 which saw the emergence of mobile accounting/bookkeeping solutions like Khatabook, OkCredit, storefront solutions like Dukaan and miscellaneous business op solutions (which include ERPs/CRMs). The same period saw the emergence of B2B marketplaces like Udaan which solved for procurement and eventually the emergence of managed service marketplaces like Zetwerk and OfBusiness. The emergence of commerce necessitated the emergence of financing solutions (anchor-led and non-anchor-led) such as Mintifi, Rupifi, etc.

The perennial question remains, where do sustainable profit pools lie? Please note the key term sustainable profit pools – which implies profit pools backed by non-commoditized offerings and protected margin profiles. Is it in financial services? Is it in software + financial services? Is it in commerce (which includes credit by extension)? Where is the gap in the market? What use cases are yet to be solved? With models like Zetwerk and Mintifi turning operationally profitable, we are seeing signs that rapid scale and profitability can be achieved in tandem by tapping into SMB spending.

After having spoken to a few hundred founders solving for the Indian SMB space, we wanted to get a pulse from the SMBs themselves. We spoke to SMBs with the aim of understanding their day-to-day activities, motivations, which services they consider critical and which ones they don’t. We brainstormed with them to understand what they would build in-house and what they would prefer to outsource, what is critical and what isn’t.

Understanding the general workflows in manufacturing and services –

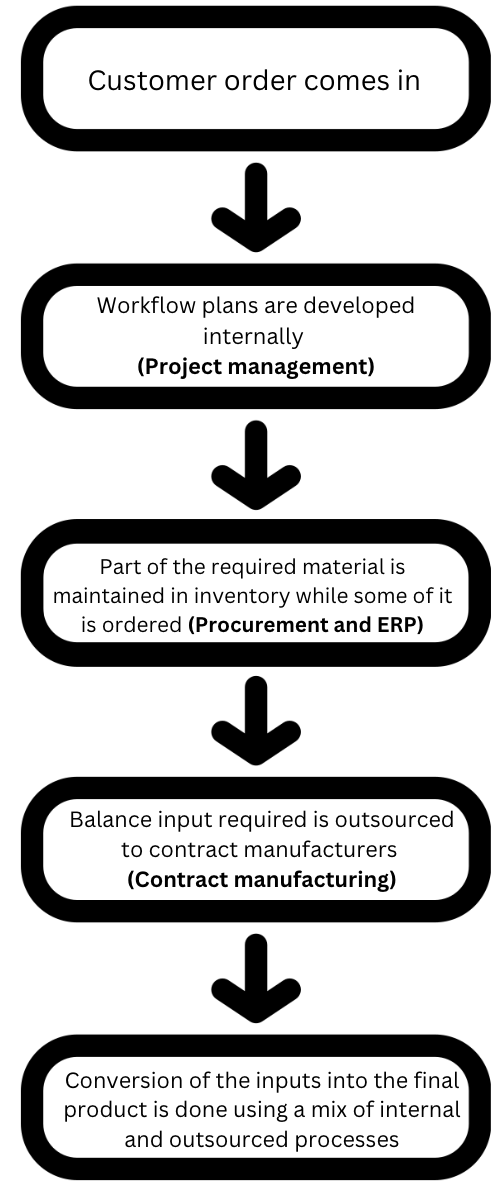

A sample manufacturing workflow (and key bottlenecks/ key points of disruption which can be solved using technology have been mentioned in brackets) can be as follows:

Procuring Financing at various stages is also critical to the entire workflow.

Services workflows are more varied – they differ significantly from logistics service providers to restaurants/hospitality service providers to construction services. However, the core workflows can be abstracted out as follows – discovery (finding customers), financing, procurement and project management.

Beyond the above-mentioned key activities, there are several compliance-related pain points/activities which are industry-specific. For example, pollution control is critical for textile printing businesses.

“Pollution is a big headache – factories are across the state. Water pollution is an issue for textiles across the board. Water needs to be treated well, current solutions are not satisfactory.”

– Small business (Textile printing)

“Our main problem is dealing with so many policies, every state has a different required label with different MRPs, different warnings to be put- logistically it’s a lot of extra effort for the company”

– Large business (Alcohol)

Software solutions seem to be attracting attention as well, however, we are uncertain of the underlying profit pools.

“ If a software comes up that allows us to manage our projects more efficiently, we’d be willing to pay for it. Labour shouldn’t be occupied in things like accounting.”

– Residential Business construction, small business (Construction)

Automation solutions are in demand for large SMBs (think INR 100 Cr+)

“Limitation of lower levels of automation is that the Indian scale of industrial manufacturing of companies like ours is 5x lower than abroad.”

– Large company (Industrials)

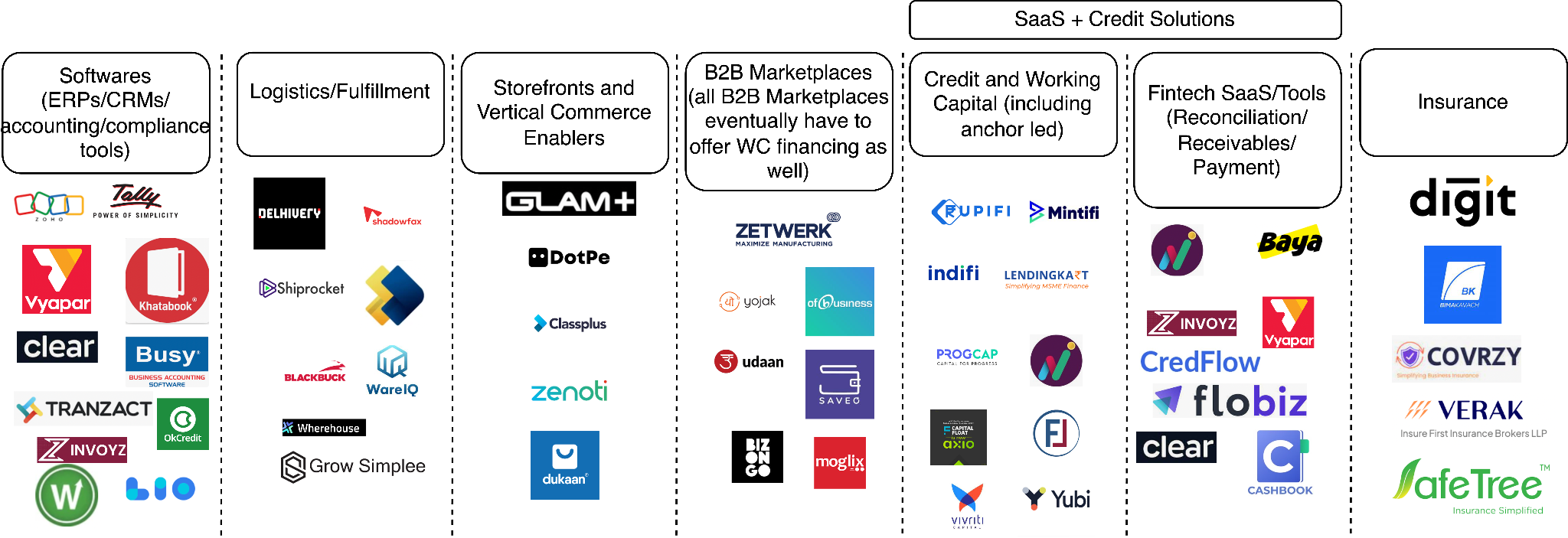

Sharing a market map which highlights all the core use cases and some of the models solving for the same –

Our attempts to neatly map unsolved use cases onto parts of the workflow yielded interesting insights:

SMBs can be broken down by size and sector. In our study, we broke down our sample by size of business (< INR 5 Cr, 5- 20 Cr, 20 Cr – 100 Cr, 100 Cr+) and by sectors of businesses [manufacturing – which includes electricals, industrials, chemicals, construction, etc.; services – logistics, hospitality, etc.]

However, the goals of the promoter are what stood out as a key insight. Most businesses’ intent to adopt technology (and pay for solutions) seems to be a function of their desire to grow. For example, we spoke to a business which was < INR 5 Cr and grew to over INR 20 Cr year-on-year. The promoters were excited about growing the business to an INR 100 Cr+ size and were thinking actively about their expansion strategy. They were open to adopting technology-enabled solutions which would not be efficiently solvable in-house, i.e. their existing supplier/vendor base was not enough or they did not have the necessary personnel/know-how to pull it off.

While they have a sense of where they want to reach from a scale standpoint, there are several unanswered questions on how to get there. Often, promoters do not have a clear idea of the challenges they will face going forward as they scale their business and seem to be broadly open to new technology solutions and financing options.

Larger businesses (INR 150 Cr+) with growth-centric founders tend to be more keen on building everything in-house (including technology).

“We tried using Salesforce, but it was not specific to our sector and the licensing fees were very high. Now we have created an in-house integrated ERP (CRM +ERP) which we’re building for commercial sale and use as well.”

– Mid-sized company (Industrials)

Discussions with promoters on technology adoption irrespective of size boil down to a build v/s buy debate.

Small businesses (<5Cr) have the highest friction to technology adoption and don’t tend to do so unless there is a compliance need OR their anchor customers/vendors make them adopt the tech. Small businesses (<5Cr) which are more than a generation old tend to remain in status quo with little incentive for the promoter to adopt tech solutions or want to grow.

| Importance | INR 1 – 35 Cr | INR 35 – 100 Cr | INR 100 Cr + |

| Procurement/Inputs | Low-Mid | Mid | Mid |

| Project/Workflow Management | Low | Mid | Mid |

| Automation Solutions | Low | Mid | High |

| ERP/CRM SaaS Solutions | Low-Mid | Mid | Mid – High

(would prefer company company-specific solution) |

| Payment Recon/B2B Payments and collection (Fintech SaaS | Mid/High | Mid/High | Mid |

| Financing + Fintech SaaS | Mid | Mid | Mid |

| Compliance | High | High | High |

| Others | Industry dependent | Industry dependent | Industry dependent |

Despite the challenges, we feel the Indian SMB story is a promising one

If you feel you are building in the space, please do reach out to us!