The report paints a picture of an ecosystem at an inflection point: optimistic founders, emerging policy tailwinds, and global demand-side pull are converging to create fertile ground for India to become a deeptech powerhouse. Yet, the journey is fraught with challenges across capital, talent, infrastructure, and global market access.

This blog distills the report into its major themes, sectoral highlights, and key takeaways.

Why Deeptech, Why Now?

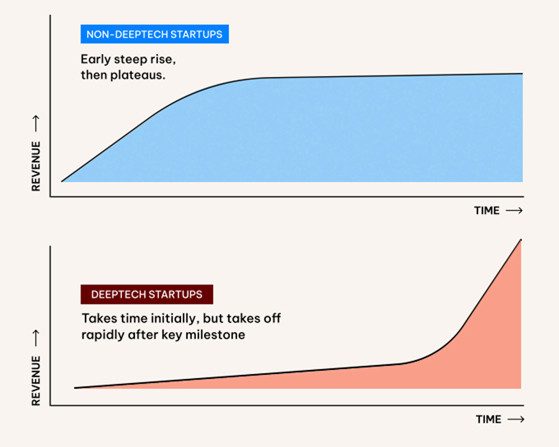

Deeptech ventures are different from the typical consumer internet or SaaS startup. They require years of R&D, patient capital, and deep scientific expertise before hitting product-market fit.

But once the breakthroughs arrive, the impact is transformational; disrupting industries, creating new markets, and driving exponential value creation.

The report highlights three forces that are aligning to give India an edge:

- Geopolitics and supply chains – Critical technologies like semiconductors, defense systems, and energy infrastructure are no longer just economic assets but strategic levers of national power.

- Policy momentum – Programs such as the National Quantum Mission, Green Hydrogen Mission, and PLI schemes are accelerating local ecosystems.

- A maturing entrepreneurial ecosystem – A new generation of founders, inspired by past successes, is now daring to tackle science-heavy problems.

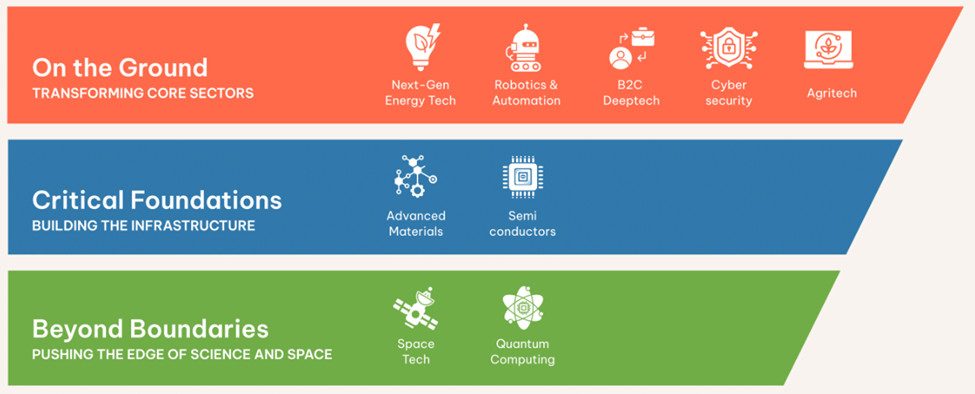

Sectoral Insights: Where the Opportunities Lie

1. Next-Gen Energy Tech

India’s energy landscape is being reimagined around the government’s 500 GW non-fossil target by 2030. While large-scale generation projects dominate headlines, startups are driving innovation in distributed solar, EV charging, green hydrogen, and energy storage.

Companies like Arkahub, Exponent Energy, Smart Joules, and Newtrace are leading this transformation. Arkahub, for instance, is building the digital backbone for India’s clean energy transition, creating a unified data and intelligence layer for renewable asset management, storage optimization, and grid integration. By turning real-time energy data into actionable insights, it’s helping utilities and enterprises unlock efficiency and transparency across the value chain.

Megatrends shaping the sector include:

- Distributed infrastructure (microgrids, smart meters, EV charging).

- Domestic manufacturing of solar modules and advanced batteries.

- AI- and IoT-enabled optimization of grids and industrial energy use.

- Novel chemistries in storage and battery recycling.

The long-term play is clear: startups that enable affordable, resilient, and sustainable energy infrastructure will be critical to India’s industrial growth.

2. Robotics and Automation

Labor shortages, rising wages, and supply chain complexity are fueling automation. From warehouse robotics to agricultural drones, startups are addressing bottlenecks across manufacturing, logistics, and farming.

The report notes India’s unique position: a large domestic market with rising demand, coupled with engineering talent capable of building globally competitive robotics solutions.

This rare combination is powering the rise of ventures like Cartesian Robotics, which is developing modular robotic systems that bring precision automation to industrial settings. With a focus on flexible design and intelligent software, Cartesian is helping Indian manufacturers adopt automation faster and at a fraction of global costs, an important step toward globally competitive productivity.

If scaled effectively, robotics could redefine productivity across agriculture, defense, and industry.

3. Agritech

Agriculture, which sustains nearly half of India’s workforce, faces structural issues: low mechanization (<50% vs 90% in developed economies), limited credit access, and labor shortages. But these gaps are opportunities for Deeptech-led transformation.

Startups are innovating in:

- Agri-drones for spraying and monitoring.

- Sensor-driven irrigation and disease detection.

- Farm robotics for mechanization.

- AI-powered analytics for better yields and market access.

With policy reforms, investor confidence, and digitization, India could emerge as a global agritech leader over the next decade.

4. Cybersecurity

India’s digital economy, with nearly a billion users, is a prime target for cyberattacks. Yet, 74% of SMEs suffered cyberattacks last year, and 60% never fully recovered. The gaps are stark: fragmented tools, a massive talent shortfall, and limited global certifications for Indian vendors.

Key themes for the future:

- AI-native cybersecurity platforms that unify multiple tools.

- Affordable, SaaS-based security for SMEs.

- Compliance-by-design solutions that embed DPDP, GDPR, and SOC2 standards.

- Post-quantum cryptography and AI-vs-AI defense systems.

Among emerging players, BPR Hub is carving a niche by bringing automation and intelligence to the compliance stack. Its AI-driven platform helps companies stay audit-ready across global standards like SOC2, ISO, and DPDP, significantly reducing the time and cost associated with enterprise-grade security. As cybersecurity grows more complex, this compliance-first approach could become a critical enabler of trust for digital India.

If executed well, India could evolve from being a consumer of global tools to becoming a builder of AI-first, world-class cyber platforms.

5. Advanced Materials

India’s advanced materials sector is demand-rich but supply-fragile. Despite being a $5B+ market in 2021, it remains fragmented and import-dependent. Yet, with the right push, the sector could underpin multiple industries; renewables, EVs, aerospace, healthcare, and construction.

One of the companies redefining this space is RecommerceX, which is pioneering circular manufacturing by recovering and re-engineering materials from industrial and consumer waste. Its platform blends chemical innovation and automation to convert end-of-life products into high-quality raw materials for electronics, automotive, and packaging industries, advancing both sustainability and self-reliance.

Growth drivers include:

- PLI incentives for EVs, solar, and semiconductors.

- AI-driven discovery of novel materials.

- A national push for rare earth and critical mineral security.

- Applications in bioplastics, nanotech-enabled healthcare, and defense.

The takeaway: India must invest in labs, testing facilities, and pilot plants to translate strong academic research into commercial breakthroughs.

6. Semiconductors

India’s semiconductor market is projected to double from $54B in 2025 to $108B by 2030. However, challenges remain, import dependence, manufacturing talent shortages, and tough global competition.

Encouraging signs include:

- Government’s $10B+ incentives for semiconductor fabs and design.

- Rising investor confidence in fabless design startups.

- Potential to build a RISC-V ecosystem akin to China’s.

- Edge-AI chips and microcontrollers as natural starting points.

Semiconductors are the bedrock of national competitiveness. India’s long-term bet will be building a robust design-to-manufacturing ecosystem.

7. SpaceTech

India’s space economy, projected to exceed $40B by 2040, is opening up to private players. More than 140 startups, from Skyroot’s launch vehicles to Pixxel’s earth observation satellites, are redefining the sector.

Policy enablers like IN-SPACe and relaxed FDI norms are fueling momentum. With ISRO’s support and cost-efficient launch capabilities, India could capture a significant share of the global space market.

8. Quantum Computing

Quantum technologies are still nascent, but India is investing early. The National Quantum Mission is driving collaboration across startups, academia, and global partners. The market is projected to grow at a 27% CAGR through 2032.

Use cases are shifting from research to industry pilots in cybersecurity, finance, defense, and optimization. The big opportunity lies in building both hardware components (lasers, photonic links, cryo-CMOS) and software stacks, areas where India traditionally has an edge.

What’s Holding India Back?

Across these sectors, common challenges emerge:

- Talent shortages in areas like quantum, advanced materials, and cybersecurity.

- Capital intensity, especially for hardtech infrastructure like fabs, nanolabs, and pilot plants.

- Slow adoption by risk-averse industries and governments.

- Import dependence on critical minerals, components, and certifications.

These barriers make Deeptech a long game, but they also create white spaces for committed entrepreneurs and investors.

Conclusion

The Deeptech Report 2025 is both a map and a call-to-action. It highlights where India is strong – talent, software, frugal innovation, and where it lags – hardware, certification, capital depth. But above all, it underscores a simple truth: the future of national competitiveness will be written in deeptech.

For founders, it is an invitation to tackle the hardest problems. For investors, a chance to back defensible IP and transformative companies. For policymakers, a reminder that resilience and sovereignty are forged not just in boardrooms, but in labs and fabs.

Deeptech is hard. It takes time, talent, and tenacity. But when it works, it transforms industries, economies, and nations.

The India Deeptech Report 2025 is our effort to capture this moment of awakening, spotlighting the entrepreneurs, investors, and policymakers who are building India’s future at the frontiers of science and technology.