We spent the last few months evaluating companies that could potentially make or break the backbone of our country – The Unskilled Youth of India.

When we approached this sector, the objective was to understand whether solving the “Skill Gap” was a scalable problem.

To take a step back – the market size was huge. 18Mn undergraduates in non-tech courses graduating in 2020 alone and 5-6Mn on the Tech side. Plus the section of working professionals looking to upskill themselves (at least 20Mn in white-collar jobs). With edtech products being sold and bought at 20K+ INR per course, the overall TAM was clearly north of a couple billion.

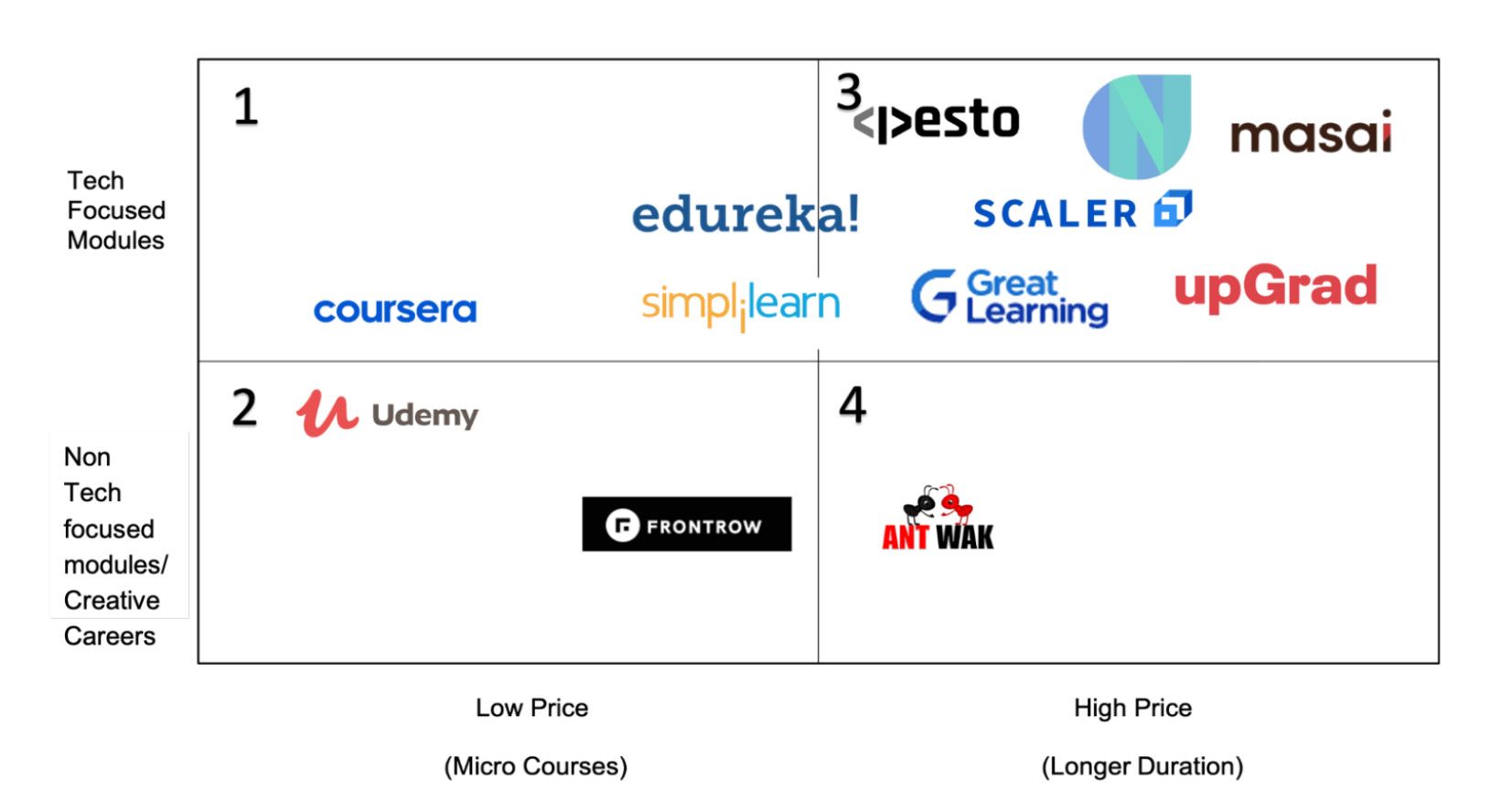

As we looked at this market, each player could be categorized on the basis of their courses, content type, and pricing (broadly).

With the rise in remote work and access to a highly-skilled tech workforce at 1/5th the cost when compared to the US, the market for tech-based upskilling & hiring was getting deeper and highly demanded in India. On a YoY basis, hiring in the tech sector grew 163% in June according to data from Naukri.com

But clearly, there seems to be white space for lower-priced tech-based courses and low or high-priced creative careers (or soft skills) focused on edtech players

Now the question was

– What differentiates the new players from the others in the market?

– How do we solve for engagements & outcomes for the learners?

– Can skilling reach the next half a billion at affordable prices?

The answers to these questions came from a few observations that we made from our discussions with founders building in this category, as below:

1. Companies focused on Upskilling had reached only the top 1-5% crowd of the country.

The majority of the courses were beyond the paying capacity of the majority of the people in the country. So how did the newer players make this more accessible?

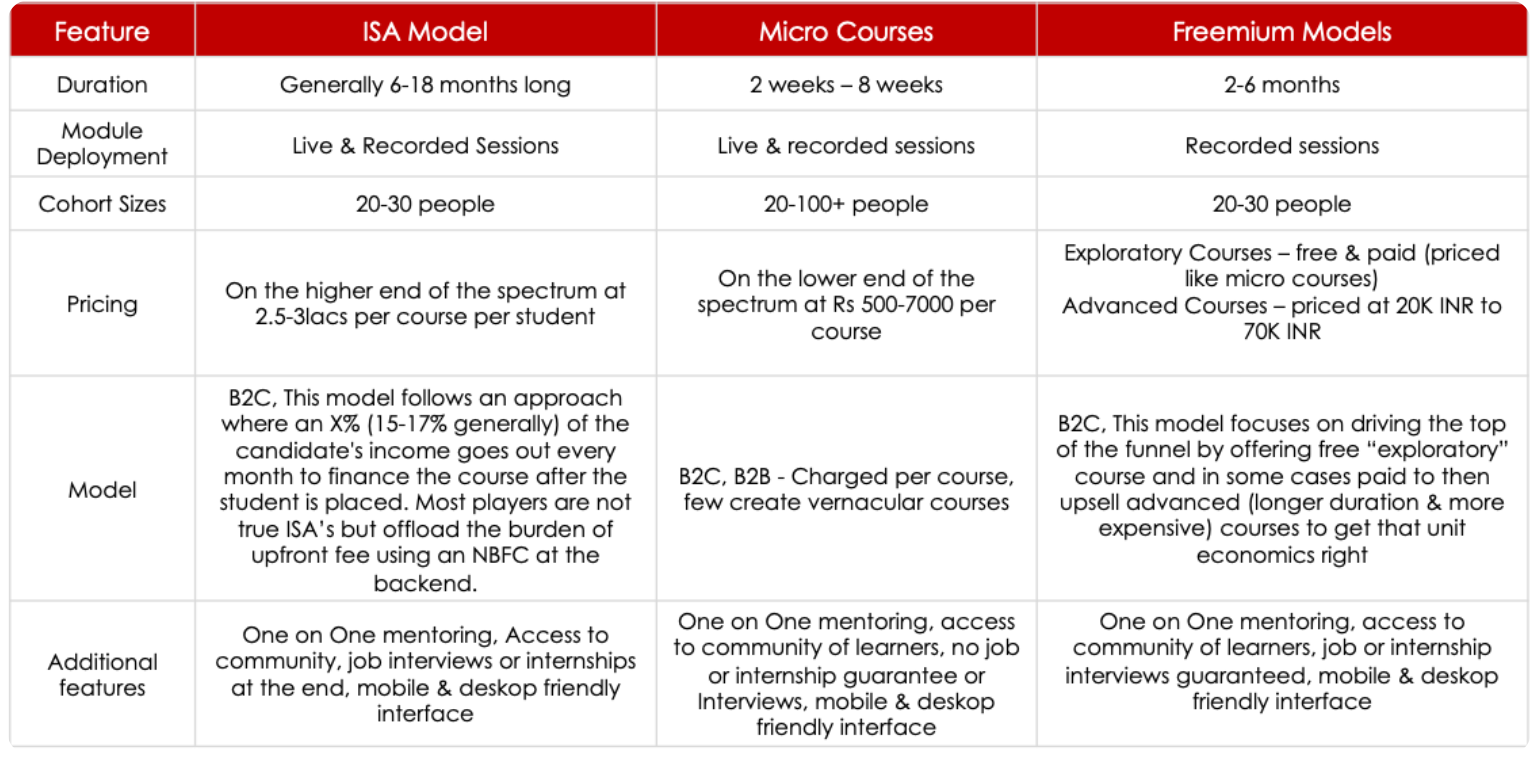

Most upskilling companies operate on either of the 3 models as shown below:

2. Why are more startups emerging in this category, when companies like Udemy and Coursera already provide micro as well as longer courses across both tech & non-tech domains? Where is the differentiation?

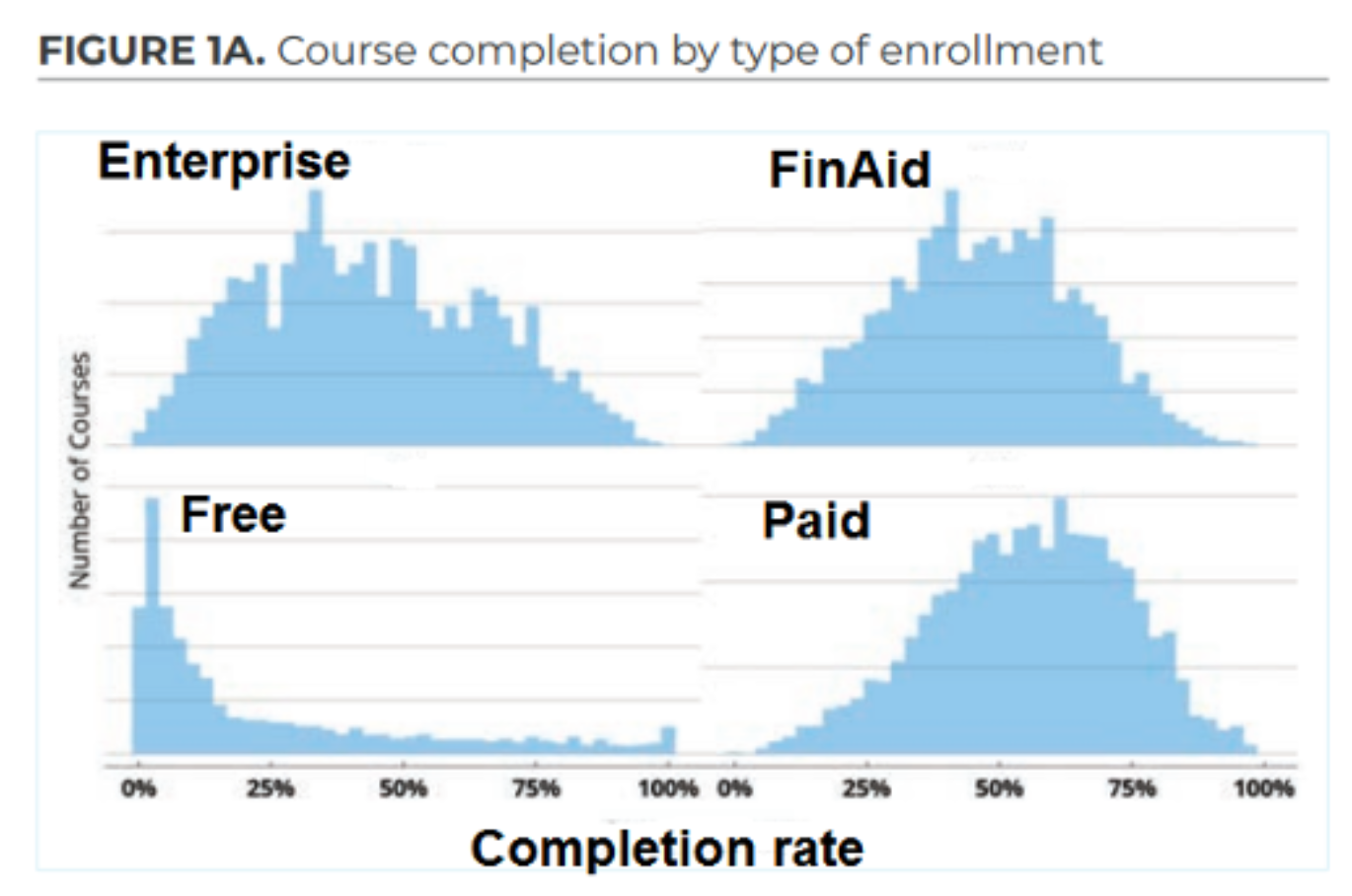

The differentiation came from a deep focus on outcomes & customer experience which Udemy & Coursera failed to address. For these companies, the course completion rates (% of people completing the entire course) were around 7- 10% until 2019. They did not focus on engaging the customer. They provided their courses like movies on Netflix. Nobody is going to binge-watch that!

But to their credit, Coursera published a report in 2020 which showed that post-pandemic, their completion rates for paid courses were averaging at ~55%. (Read Here)

Of course, being one of the largest players in this space at the moment, I would attribute the increase in this % to the tailwinds in the market for online learning and not to an improvement in the learning experience for the consumer.

People are looking for 2.0 methods of teaching online and clearly needed intermittent nudges to get them to stay engaged and complete the course. (If you have a different view, would love to chat at sonia@kae-capital.com!)

When newer players came to solve this, they identified that customers wanted to ask doubts, get real-time answers, connect with experts in the industry or peer learners and most importantly want to see an outcome more than a certificate. Most people will invest their time and energy if they either get a job, internship, or some real-world application.

3. This paved the way for a more holistic upskilling approach.

Companies focused on engaging the customer by improving the overall UI/UX, making the journey exciting with intermittent milestones, gamifying the experience using rewards and gifts, onboarding young industry experts (to increase approachability and relatability), focusing on partnering with companies that were hiring to directly engage with the learners with real-world projects and finally actually providing the network to get a job (no one actually guarantees a job, it is mostly a promise of getting access to 3-5 job interviews) at the end of the course

4. As competition increases in the seed stage for such companies, It is becoming harder to differentiate the newer players. Branding will become extremely important from Day 0

Beyond the courses themselves, all companies focus on similar offerings as highlighted in the table earlier, so selling the story of the brand, its teachers, its hiring partners and the unique power of its community will become critical nuances that a learner will scout for when selecting a course.

5. A major challenge with these models is that as the ecosystem matures, the cost of acquisitions is bound to increase.

As more edtech products get bombarded at people on a regular basis, it will be increasingly difficult to grab a piece of their mindshare. And thus, Customer Acquisition Costs will shoot up. Today it is anywhere between 1000 – 3000 INR for most companies in upskilling. Assuming this will go up by 20-25% each year based on a historical average.

At such CACs, Lower Priced Courses or Micro courses would have to either find extraordinary ways to acquires new users (B2C), or their LTV: CAC ratio would suffer in the long term.

In the short term, the relatively cheaper prices would make sense to acquire users fast, but for the company to scale to over a 100Mn in ARR at profitable unit economics would require them to eventually step up the prices, to ultimately land up in the same bucket as the ones following higher-priced/ISA models (anything above 20K INR per course at the current rates)

An interesting way some companies solved this is by onboarding celebrities as course tutors (following the masterclass model). By doing so, most of the top-of-the-funnel conversions came because of the traffic driven by the celebrity’s brand. This allowed them to continue at a lower price while keeping the paid CACs low. However, engagement for students may not be high here, which leads to low customer retention. Again, time will tell if this model breaks out.

6. Price of the course is hardly a differentiating factor for these companies in the long run. But a great hook to acquire new users.

The price of the courses is a culmination of the cost of creation of the course and revenue share for mentors/experts who helped curate the course among other costs. Courses that today are priced in the 1000 – 9000 INR category would eventually have to price it upwards as CACs increase.

However, offering good quality exploratory courses at cheaper prices or even free could create a strong funnel that could be leveraged to upsell the acquired user to buy more expensive courses to eventually justify the CAC.

7. Learners pay for the content, but is Content really a moat anymore?

Companies that have a high course price, generally invest in creating their own courses in partnerships with industry experts or leaders. Which is why they were priced so high.

Today, edtech ecosystem all over the world has matured enough that there is plenty of great good quality content available out there. Using the existing content on the internet, content can be created in a couple of hours with one or two engineers and with one line of code. Earlier, it took an entire content, R&D, and engineering teams several weeks & months to create courses to sell. To play the devil’s advocate, one can say that this content will not be original and hence of subpar quality in comparison.

Truth is, it probably may not matter that much. No student gets to go through the entire content before they pay for the course. If companies are able to drive top-of-the-funnel conversions by using free content and then effectively upselling them higher-priced modules, it could still help with keeping the CAC low. It seems very hard to believe that courses that are created in-house will be extraordinarily different from the ones using NLP over the next 10 years. But low-quality content could create poor word of mouth, a powerful tool that if played poorly could reflect in low NPS scores.

(NPS for a lot of upskilling companies is north of 60, which is extremely high in the category and to our understanding could become the new benchmark in edtech.)

The ecosystem for upskilling companies that are already in the market is ripe and it is a great time for the existing players to grow but it would get competitive as several newer players have come in the last couple of years. The market is large and is ever-increasing as learning is seen as a lifelong activity. For the players coming post-2020, it would get harder to differentiate and maintain healthy margins as acquisitions become expensive at scale. Edtechs will have to figure out innovative ways to get to mass India while being profitable.

To sum this all up in one line – for any new player coming in the market, the key would be to crack Branding + Customer Experience + Customer Acquisition (Retention) + focus on outcomes before anything else, to be able to capture the market

The current school of players have plenty of scaling to do on their hands and we can hope that this would pave the way to edtech 3.0 soon